Pensions are often spoken about with a mix of reverence and confusion. For some, they represent safety and stability. For others, they feel outdated, opaque, or even illusory. Much of the debate around pensions today comes from misunderstanding what they truly are, what they promise, and what they do not.

To understand pensions clearly, we need to separate myth from structure.

What a Pension Actually Is

At its core, a pension is a long-term income arrangement designed to provide money after you stop working. It is not a pile of cash waiting for you. It is a system that converts years of contributions into future payments.

Pensions exist to solve one basic problem: how to spread income across an entire lifetime, especially the years when earning through work becomes difficult or impossible.

There are two main ideas behind pensions:

– deferred income

– risk pooling

You give up some money now so that you receive income later, and the system spreads risk across many people rather than leaving each individual to face old age alone.

The Two Main Types of Pensions

Traditional pensions, often called defined benefit plans, promise a specific income for life, usually based on salary and years worked. The risk is carried by the employer or the institution managing the fund. These pensions feel stable because the payout is known in advance.

Modern pensions and retirement accounts are usually defined contribution plans. Here, you contribute money, it is invested, and your future income depends on market performance. The risk shifts from institutions to individuals.

This shift is one of the most important changes in modern economic life.

What Pensions Are Not

A pension is not a savings account you can freely access at any time.

It is not guaranteed wealth.

It is not immune to economic change.

Many people assume pensions are “safe” in an absolute sense. In reality, they are as stable as the systems, markets, and governments that support them.

Pensions are also not personal ownership in the way property or cash is. They are contractual promises governed by rules that can change.

Why Pensions Were Invented

Pensions emerged in response to industrial society. Before them, old age depended on family, land, or charity. As people moved to cities and worked for wages, those safety nets weakened.

Pensions were created to prevent poverty in old age and to provide social stability. They were as much about society as about individuals.

In this sense, pensions are social technology, not just financial products.

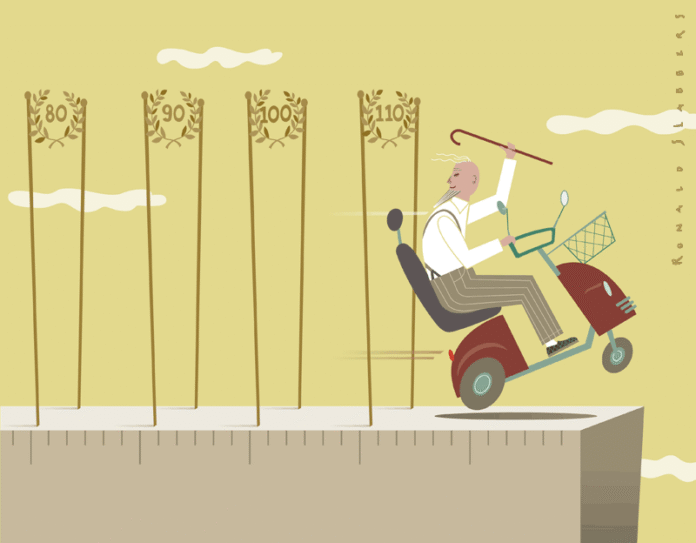

The Illusion of Certainty

For decades, pensions were presented as guarantees. Work hard, contribute, and you will be taken care of. That narrative no longer fully holds.

Longevity has increased. Markets fluctuate. Governments adjust policies. Employers retreat from long-term obligations.

Pensions still provide structure, but not certainty.

They manage risk. They do not eliminate it.

Why Pensions Feel Untrustworthy Today

Many people distrust pensions because they are abstract. You pay into something you cannot see, touch, or control for decades. Meanwhile, stories of underfunded plans, policy changes, and inflation erosion circulate widely.

This distrust is not irrational. It reflects a broader shift where individuals are expected to manage risks once handled collectively.

The pension hasn’t disappeared. Responsibility has moved.

What Pensions Still Do Well

Despite their limitations, pensions still offer advantages that are hard to replicate alone:

– long-term discipline

– tax efficiency

– protection against outliving your money

– shared risk

They are slow by design. And slowness, in finance, can be a form of protection.

The Real Question to Ask

The most important question is not whether pensions are “good” or “bad.” It is whether people understand what role pensions are meant to play.

A pension is a foundation, not a full plan.

A system, not a guarantee.

A tool, not a promise of comfort.

What Pensions Require From You

Pensions require patience. Trust in institutions. Acceptance that the future cannot be perfectly controlled. They work best when combined with other forms of financial resilience, not when treated as a single solution.

They are designed for stability, not abundance.

What They Reveal About Society

How a society treats pensions reveals how it thinks about aging, responsibility, and time. When pensions are strong, risk is shared. When they weaken, individuals are left to navigate uncertainty alone.

In that sense, pensions are less about money and more about values.

They are not a guarantee of comfort.

They are a statement about how much a society believes in taking care of its future selves.

Understanding that difference is where clarity begins.

Views: 0